What to Expect: Energy

President Trump is wasting no time focusing on his campaign promise to upend federal energy policy.

In just a few short weeks, the White House moved swiftly to freeze federal climate funding and successfully install the key executors of his energy agenda atop the Departments of Transportation, Interior, Energy, and the EPA. The federal government’s pivot away from net-zero policies will have a ripple effect across major industries — like manufacturing and technology — as well as state legislatures, municipalities, and household ratepayers.

Precision Strategies regularly works with clients to go in-depth on target audiences to gain a nuanced understanding on key issues, design persuasive messages, and test them with speed and accuracy. We recently conducted a survey of 1,000 general population adults across Ohio, Michigan, South Carolina, North Carolina, and Georgia (respondents included individuals across political groups) from 2/21/25 to 2/26/25 to assess their opinion of U.S. energy policy. The survey results are weighted on age, ethnicity, and gender and has a margin of error of 3%.

We are closely monitoring emerging trends, sharing audience insights, and laying out what you can expect. Here are the takeaways:

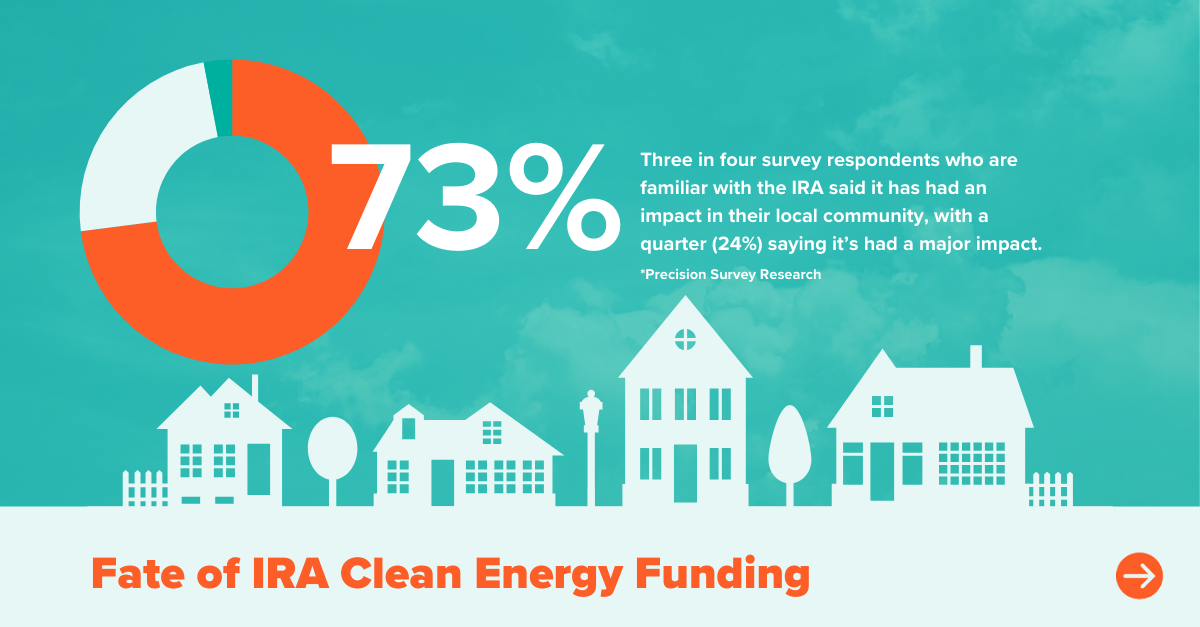

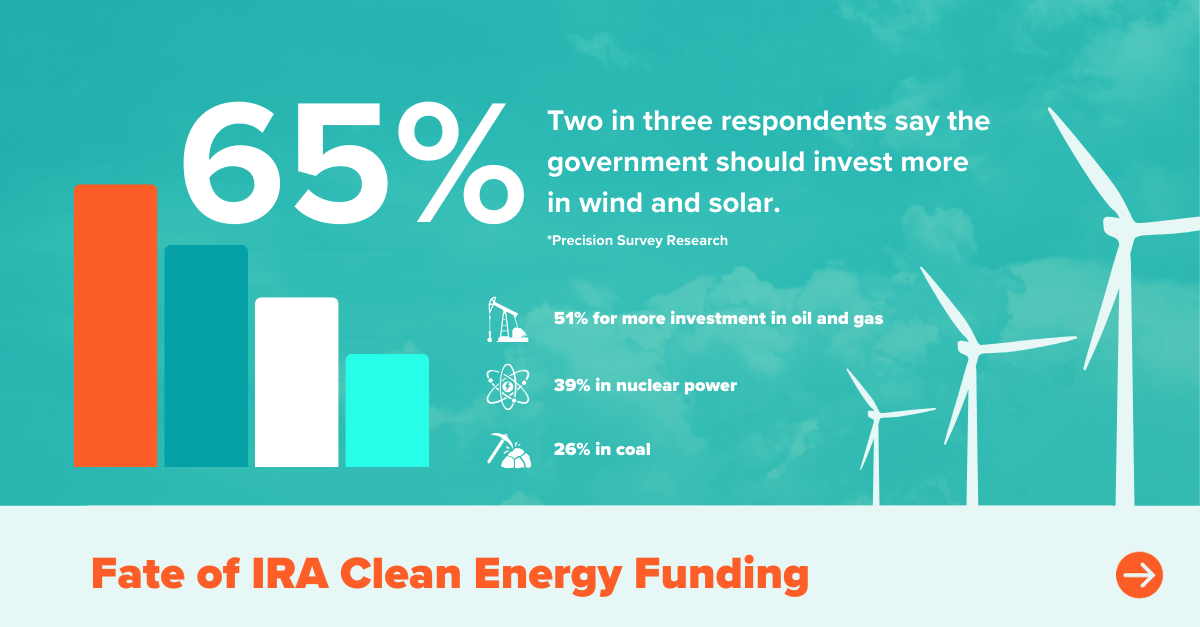

Fate of IRA Clean Energy Funding

What’s at stake: President Biden’s Inflation Reduction Act (IRA) was one of his signature achievements. However, President Trump has long raised concerns about the bill and his administration has moved quickly to begin rolling it back. During President Biden’s term funds were dispersed resulting in on-the-ground projects in dozens of states across the country that resulted in the creation of over 334,000 jobs. Many of these were created in heavily Republican areas and at the time were celebrated by local Republican leaders.

What we’re watching:

- Repeal vs. tailored approach: Over 80% of funding for IRA projects have gone to states that voted for President Trump in 2024. There has already been some Republican pushback around the idea of a full IRA repeal: Last summer, 18 members signed a letter to Congressional leaders urging a more tailored approach to rolling back funds, and last month, more backed the credits as part of the reconciliation debate. Given this opposition, many Republicans will want to protect narrow credits and will be unlikely to support a wholesale repeal. However, they may be under pressure to give the Administration a big win and repeal the bill. Companies with a vested interest in the electric vehicle, wind, and solar tax credits will look to hang on during the tax negotiations.

- Reconciliation: The House and Senate passed different budget resolutions just days apart in February that now have to be reconciled. The Senate’s skinny resolution focuses on border security, on and offshore lease sales, and defense-punting tax cuts to a later vehicle. The House, however, is charging ahead with one large bill that calls for $4.5 trillion in tax cuts with a goal of slashing spending by $2 trillion. It’s early in the process, but with a price tag of $400 billion, the IRA clean energy credits will remain an option on the table to pay for the administration’s other tax priorities.

(When asked to choose, 61% of respondents say the government should provide clean energy tax cuts that support electric vehicles, wind, solar, and other renewable energy projects instead of focusing on general tax cuts across the board.)

- IRA implementation and Treasury rule making: Treasury Secretary Bessent has indicated a strong interest in using the levers of the Treasury Department to undo and undermine the Inflation Reduction Act. Many of the law’s provisions are vulnerable to interpretations that would make its tax credits much more difficult, if not impossible, to access. Lengthy rulemaking processes are likely to continue creating even more uncertainty and instability for the energy and transportation sectors.

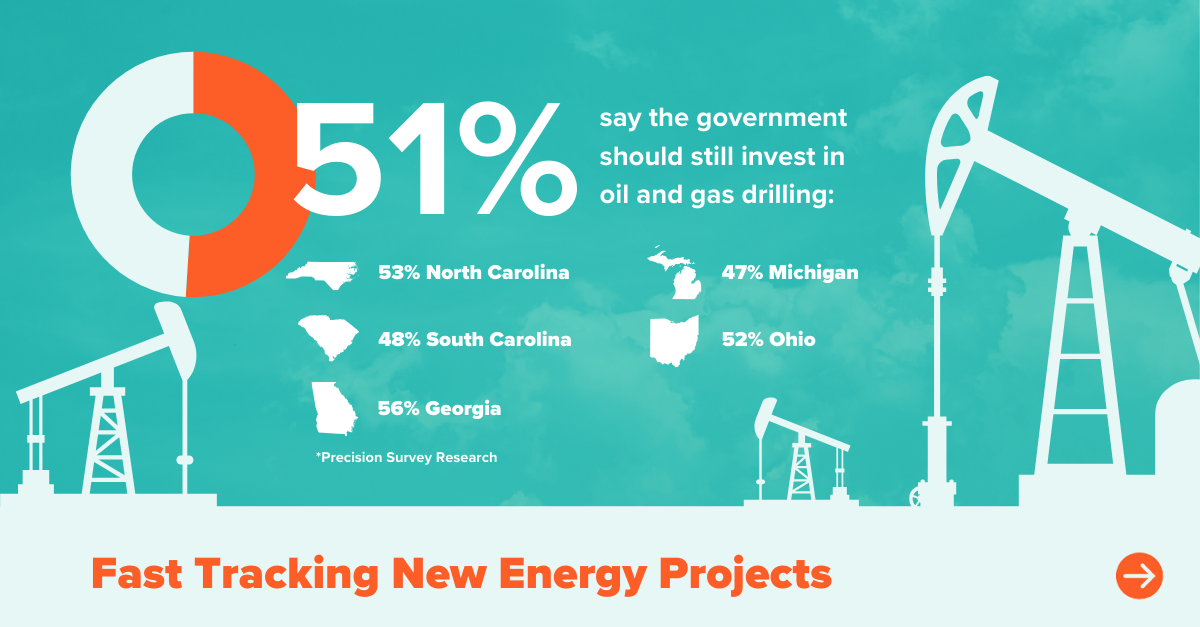

Fast Tracking New Energy Projects

What’s at stake: Companies invested in new projects that generate, transmit, or store energy would benefit from a faster federal permitting and lease approval process – top priorities for the White House and Congress. Near-term DOGE cuts will also add a layer of uncertainty for how departments and agencies can execute this goal. There has been recent bipartisan interest in expediting the permitting reform process, which aims to benefit both renewable energy with new transmission line construction and oil and gas exploration.

What we’re watching:

- Contrasting executive actions: The President’s executive order to unleash American energy kicked off a review process across key departments, including Energy and Interior, to expedite energy projects and oil and gas leasing. On the flipside, the executive order banning offshore wind projects is already having an impact in the states, halting New Jersey’s first-ever offshore wind project.

- Legislative changes: While both the House and Senate budget resolutions focus on expanding energy production, Congressional Republicans will be unlikely to enact broad policy changes to federal permitting laws under the budget reconciliation process due to procedural limitations. Bipartisan cooperation will be needed to revive a comprehensive permitting reform bill this Congress.

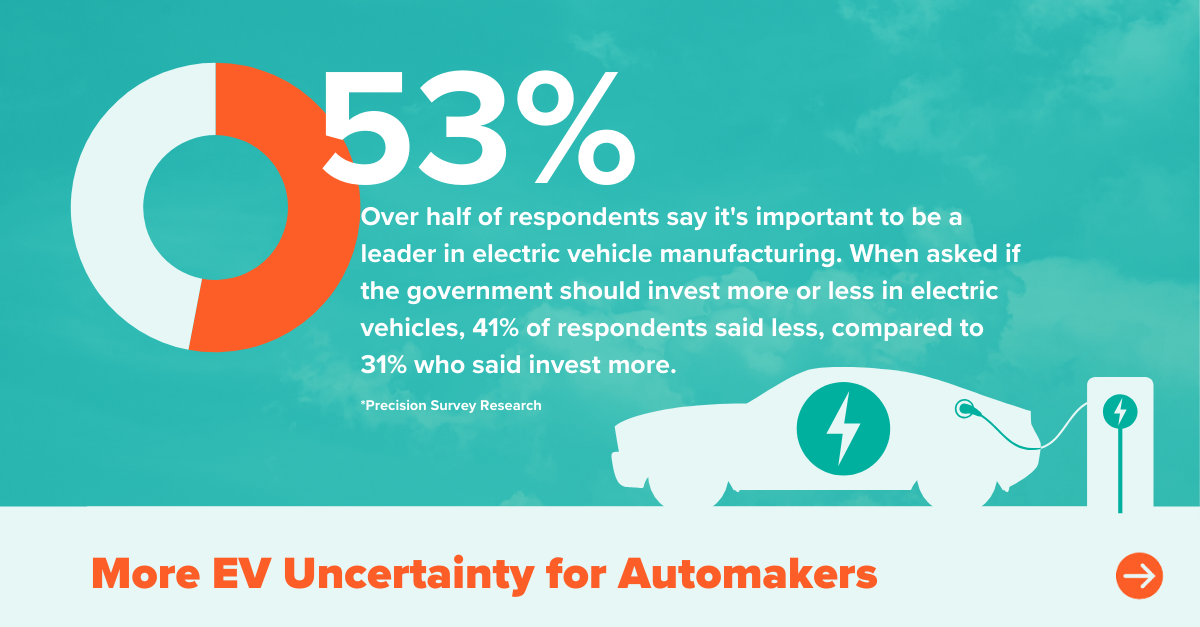

More EV Uncertainty for Automakers

What’s at stake: Uncertainty and instability for U.S. automakers who have already made long-term product investments for EVs and future car and truck model years to meet current fuel economy and tailpipe emissions standards. Automakers and industry watchers anticipate that the market will move to EVs – but the question is how long that adoption process will take, and what disruption to manufacturing jobs will occur during that time.

Industry leader Tesla and CEO Elon Musk have recently advocated against government support for the EV transition, despite having been a major beneficiary of EV tax credits and other policies. Now that they’re firmly the market leader, they view such policies as undermining their competitive advantage relative to automakers who are newer in the EV game. Other American EV makers have insisted that pro-EV policies are necessary to ensure a sufficiently-paced transition and to ensure American companies and workers aren’t undercut by Chinese EVs and other imports.

What we’re watching:

- DOT and EPA rulemaking: The transportation sector is the largest source of CO2 emissions in the U.S. and has faced a seesaw of regulatory change over the last few decades. Secretary of Transportation Sean Duffy’s first act kicked off the process to reset car and truck fuel economy standards finalized under the previous administration. Expect new EPA administrator Lee Zeldin to carry out the President’s pledge to reverse the previous EPA’s final rule that cut tailpipe emissions by 50% from 2026 levels by 2032.

- California: Federal law allows California — by seeking waivers with the EPA — to set its own stricter vehicle emissions standards and also allows other states to adopt those standards (as happened during the first Trump administration). The new administration will look to claw back previously approved EPA waivers — setting up litigation battles and prolonged industry uncertainty in the face of a potential patchwork of state and federal standards. The last time around, a group of automakers made an agreement with California to abide by stricter standards nationwide.

ESG

What’s at stake: ESG policies were already becoming an increasingly polarizing topic prior to the election, and given the stated goals of the Trump Administration, will likely continue to be a focal point. In his first two weeks alone, President Trump signed dozens of executive orders, many of which were related to ESG, including pulling out of the Paris Climate Agreement.

What we’re watching:

What we’re watching:

- State legislative sessions: In addition to national action, we expect to see a division at the state level between states that aggressively pass anti-ESG measures vs. ones that are steadfast at continuing pushing for ESG standards. This trend has accelerated over the past several years, with bills ranging from making investment decisions without consideration of ESG criteria to restricting contracts to entities with an ESG focus. Whether states continue to push new bills that contain ESG measures will be an indication of where the fight is heading on a local level.

- Company investment: Many companies have been focused on expanding their climate goals and sustainable investments over the past decade and will need to figure out the path to take in this new political climate. Precision has a history of working with clients to navigate the ever-changing landscape and would like to work with you as you build out your strategic plan.

Powering AI Growth

What’s at stake: Increased demand for AI and cloud computing means a growing need for power. More data centers are needed to keep pace with AI growth, which is increasing our demand for electricity. Major tech players are looking to revive nuclear power as a carbon-free electricity source.

What we’re watching:

Find out more in our next “What to Expect” edition, where we break down what we’re monitoring in the technology industry.

New executive energy priorities, tax reforms, and a shifting regulatory environment will have a far-reaching impact on energy and environmental policies. We are ready to help companies and organizations navigate this uncertainty and take full advantage of future opportunities.

To learn more about how we can help your team, reach out.